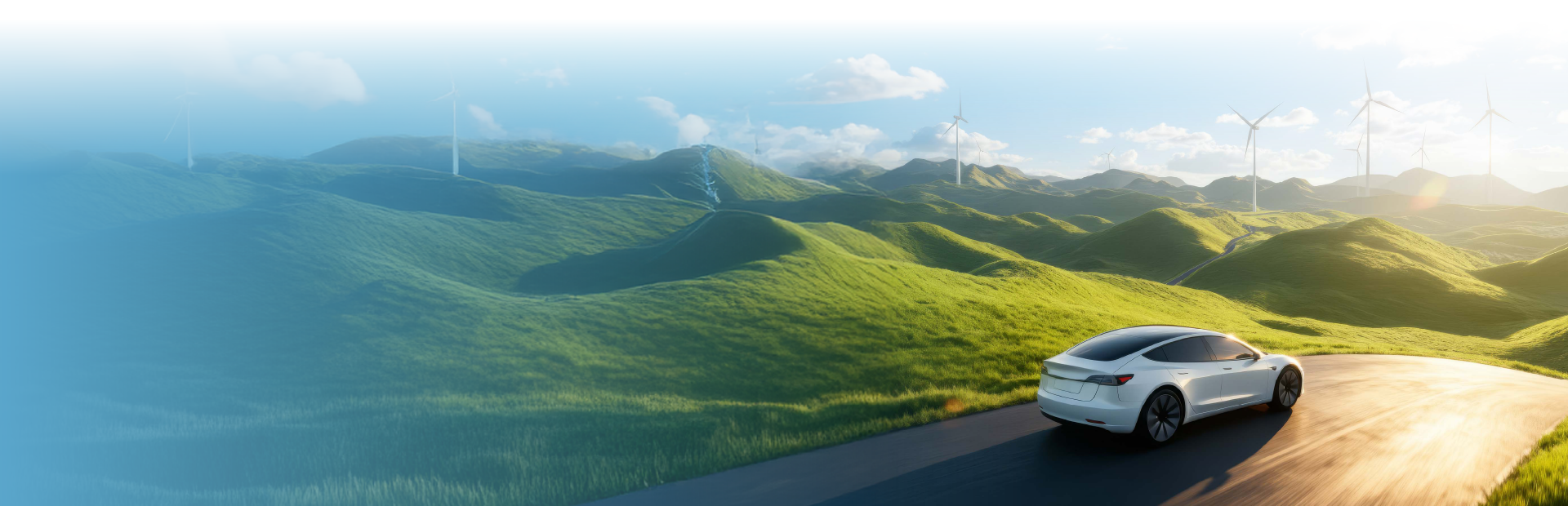

As the roar of internal combustion engines gradually fades, this signals a transition toward electric automotive innovation, or EVs, which are driving forward quietly yet accelerating to overtake traditional vehicles in the automotive market.

The arrival of electric-powered EVs presents several compelling aspects, ranging from the future of oil-fueled cars and continuously rising EV sales to the management of battery waste that will increase in the future, as well as the key innovations behind these vehicles. All of these represent new perspectives that we wish to present for everyone to follow.

2025 Electric Vehicle Market Update: Sales Increase by 25%

Data from the Global EV Outlook report by the Electric Vehicles Initiative (EVI) presents the latest progress on electric vehicles. It summarizes that in 2024, global electric vehicle sales exceeded 17 million units, accounting for 20% of total car sales. The increase of 3.5 million units in this single year surpasses the total global electric vehicle sales in 2020. Furthermore, it is projected that in 2025, electric vehicle sales will exceed 20 million units globally, representing one-fourth of all car sales.

Although the overall sales figures for EVs are growing remarkably, a deeper regional analysis reveals that in 2024, China remained the leader in electric vehicle sales, with an increase of nearly 40%. Meanwhile, emerging markets in Asia and Latin America saw sales increase by over 60%, particularly in Southeast Asia, where sales grew by nearly 50%. However, looking at the European and U.S. markets, the electric vehicle trend has begun to stagnate due to the cancellation of government support measures. For instance, in the U.S., EV sales slowed significantly in 2024, increasing by only 10% compared to 40% in 2023.

The Future of Internal Combustion Engine Vehicles Amidst the EV Price War

Currently, our domestic automotive industry has driven to a crossroads between internal combustion engine (ICE) vehicles and electric vehicles, with the selling price being a critical decision point

While competition in the ICE market remains flat, the EV market has turned into a fiercely contested price battlefield, especially among major Chinese EV manufacturers. The primary causes are the rapidly increasing oversupply, technological developments that have lowered battery production costs, and marketing strategies designed to stimulate sales and attract consumers away from oil-fueled cars and competitor brands.

If so, who benefits from the EV price war? The answer may not be the consumer. Although EV buyers benefit from cheaper electric vehicle prices—potentially lower than purchasing an oil-fueled car—they must accept the risks associated with after-sales service if they decide to buy an EV from a smaller manufacturer unable to provide long-term customer support. Additionally, in the case of selling the vehicle as a second-hand car, apart from the resale price depending on battery health, owners may risk encountering very high depreciation compared to general oil-fueled vehicles.

It appears that internal combustion engine vehicles possess strengths regarding resale value and relatively stable technology, which does not significantly impact production costs. However, this does not mean they can sustain their position in a highly competitive market for long without adaptation. The future of internal combustion vehicles will be repositioned as Hybrid or Plug-in Hybrid (PHEV) vehicles, which offer greater flexibility in usage because they possess both an internal combustion engine and an electric motor in a single vehicle, serving as an interesting alternative for consumers who still view that EVs do not yet fully meet their usage needs.

The Next Step for Electric Vehicles and the Major Challenge of Batteries

The heart of an EV is the battery. Previously, there were certain limitations, such as charging time and operational safety. However, at present, these challenges appear to have been addressed and continuously improved, establishing EVs as the automotive innovation of the era.

Why were electric vehicle batteries expensive in the past? Because early battery models were manufactured from expensive minerals such as nickel, cobalt, and lithium, involving complex production processes and requiring advanced technology to develop efficiency. Currently, battery prices have begun to decline due to advancements in research and development. Data from the Energy Committee of the Thai Chamber of Commerce indicates a decrease in electric vehicle battery prices over recent years. In 2010, the price of lithium-ion batteries was as high as $1,100 per kilowatt-hour (kWh), but by 2021, it had dropped to $137 per kWh, and in 2024, it decreased further to approximately $110 per kWh.

The continuous development of EV batteries has enabled manufacturers to discover significant cost-reduction methods by changing raw materials for new production, such as LFP (Lithium Iron Phosphate) batteries, which are nearly 30% cheaper per kWh than NMC (Nickel Manganese Cobalt) batteries. Other developments include Sodium-ion batteries, which use sodium—a raw material that is easy to find and has much lower costs—as well as the development of Solid-State Batteries. The latter uses solid conductors instead of the traditional liquid ones, making them safer as they are non-flammable, possess higher energy density allowing for longer driving ranges, and can be charged rapidly in just a few minutes. All of this will address the challenge of EV batteries, enabling this driving innovation to go further and faster than before.

However, if the vehicle's battery is no longer suitable for propulsion, there are still management guidelines based on the Circular Economy to maximize benefits. This entails reusing the battery in the form of an Energy Storage System (ESS) to store energy from residential or business solar cells, and it is also possible to extract metallic raw materials, such as lithium, cobalt, and nickel, for reuse.

SCGC, recognizing the growth of the future automotive business, entered into a joint venture with Denka Company Limited (Denka) of Japan—a company with a history spanning over 100 years—to conduct the business of manufacturing and distributing Acetylene Black under the name Denka SCGC Advanced Materials Co., Ltd. Currently, Denka produces Acetylene Black at a total of three plants in Japan and overseas.

Acetylene Black by Denka is distinguished as a special type of carbon black product produced from the thermal decomposition of acetylene gas. Using Denka's proprietary thermal decomposition and synthesis technology, the resulting carbon black possesses high purity and excellent electrical conductivity. It can therefore be used effectively as a component in the production of rechargeable lithium-ion batteries for electric vehicles, as well as a material for manufacturing high-voltage transmission lines for offshore wind power generation. From this collaboration, it is expected to have a production capacity of approximately 11,000 tons per year, ready to push SCGC to elevate its business towards High Value-Added (HVA) products within the lithium-ion battery supply chain for electric vehicles, which is currently in high demand in the market.

From this day forward, it is certain that the path of future automobiles will never be the same again. With the transition to clean energy for propulsion, it will be possible to truly transform every road towards sustainability, starting with innovations close to us and extending to numerous low-carbon business chains.